Introduction to Prize insurance

In the world of marketing and promotions, nothing ignites excitement quite like the prospect of winning eye-watering prizes. Whether it’s a captivating game show, a thrilling sports event, or a compelling marketing campaign, the allure of valuable rewards attracts participants and captivates audiences. However, for promoters and organisers, the prospect of shouldering the financial burden of these enticing prizes can derail an otherwise excellent campaign.

This is where Prize Indemnity Insurance comes in – a strategic and innovative solution that allows businesses to elevate their promotions to new heights without the fear of financial risk. In this article, we will dive into world of Prize Indemnity Insurance, explore its benefits, and uncover how it empowers organisers to run unforgettable promotions that resonate with participants and audiences alike.

What is Prize Indemnity Insurance?

Prize indemnity insurance is indemnification insurance for a promotion in which the participants are offered the chance to win prizes. Instead of keeping cash reserves to cover large prizes, the promoter pays a premium to an insurance company, which then reimburses the insured should a prize be given away. This premium serves as a protective barrier, assuring that if a prize is won, the insurance company steps in to reimburse the promoter for the prize’s full value.

Essentially, Prize Indemnity Insurance transforms a promotion into a win-win scenario: promoters can offer enticing rewards without bearing the burden of substantial financial commitments, while participants relish the opportunity to win jaw-dropping prizes.

Breaking Free from Financial Constraints

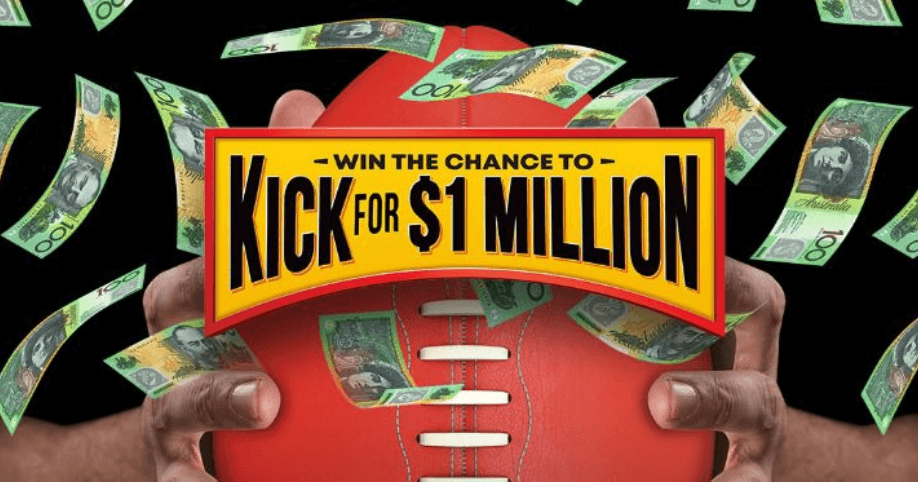

One of the most significant advantages of Prize Indemnity Insurance lies in its ability to liberate organisers from financial constraints. Imagine hosting a envelope draw with a $1 million grand prize, or a lucky wheel spin for $500,000 cash. The allure of such an event can elevate brand recognition and create a buzz among participants and spectators. However, the financial implications of paying out such large sums of money would place the campaign out of reach of most brands. Prize Indemnity Insurance provides the much-needed peace of mind, enabling organisers to focus on delivering an exceptional event without worrying about the financial risk of a prize being won.

Unleashing Creative and Dazzling Promotions

With Prize Indemnity Insurance as a powerful ally, the canvas for creative and dazzling promotions expands exponentially. Whether it’s a thrilling game show, a captivating lottery, or a promotional event with irresistible rewards, organisers can let their imagination run free. From dream vacations to high-end gadgets and cash prizes, the possibilities become limitless. This newfound freedom to offer extravagant rewards encourages participants to engage actively with promotions, creating a sense of anticipation and excitement that resonates with audiences.

A Catalyst for Customer Engagement and Loyalty

Promotions backed by Prize Indemnity Insurance are not just about rewarding the lucky winners; they serve as a catalyst for customer engagement and loyalty. Audiences are drawn to promotions with the allure of valuable prizes, eager to participate and try their luck. The feeling of being part of a unique and exciting opportunity fosters a deeper connection between customers and brands. Consequently, customers are more likely to remember and remain loyal to the brand that provided them with a memorable experience.

Striking a Balance between Risk and Reward

For businesses that rely on promotions to attract and retain customers, Prize Indemnity Insurance offers a delicate balance between risk and reward. Offering substantial prizes can yield significant returns, but the potential financial exposure can be concerning. With the safety net of insurance, businesses can confidently embark on ambitious promotions, knowing they are protected should a high value prize be won.

Conclusion

In the fast-paced and competitive landscape of promotions, the strategic use of Prize Indemnity Insurance can be a game-changing advantage. By removing financial barriers, it empowers businesses to orchestrate stand-out events, captivating contests, and engaging marketing campaigns that resonate with audiences. The allure of valuable prizes drives interest, customer engagement, and fosters brand loyalty. As promoters embrace this powerful tool, they unleash the potential to create unforgettable promotions that leave a lasting impression on participants and spectators alike. With Prize Indemnity Insurance, businesses can elevate their promotions to new heights, ensuring success and delighting their valued customers.

If you’re ready to get stuck into a promotion, we definitely recommend checking out our article, Complete Guide to Incentive Marketing.

0 Comments